In the realm of economics and finance, the discount rate plays a pivotal role in shaping fiscal policies, influencing investment decisions, and assessing the viability of long-term projects. But, do governments have their distinct expectations for discount rates, separate from financial markets and central banks? Understanding this might unravel the nuanced relationship between governmental fiscal strategies and macroeconomic stability.

Understanding the Discount Rate

The discount rate, fundamentally, is the interest rate used to determine the present value of future cash flows. This concept is vital in both public and private sectors for evaluating investments and policy decisions involving long-term financial commitments. In the context of central banks, the discount rate is the interest rate charged to commercial banks for borrowing funds from a central institution. This rate impacts the broader economy, affecting lending rates, inflation, and economic growth.

Government’s Role and Expectations

While central banks often set discount rates aiming to balance inflation and stimulate growth, governments may hold different priorities. Governments frequently base their discount rate expectations on broader socio-economic frameworks, considering factors like national debt management, infrastructure investments, and long-term sustainability objectives.

- Economic Growth Versus Fiscal Responsibility

Governments are tasked with balancing short-term economic stimulation with long-term fiscal responsibility. For instance, during economic recessions, lowering discount rates can spur economic activities by making borrowing cheaper, which could be aligned with government efforts to boost employment and consumer spending. However, governments also need to be cautious. Adopting a lower discount rate while ignoring potential inflationary pressures or fiscal deficits could lead to economic instability. Therefore, governments often set expectations by blending market signals with overarching fiscal policies.

- Public Sector Investments and Long-Term Projects

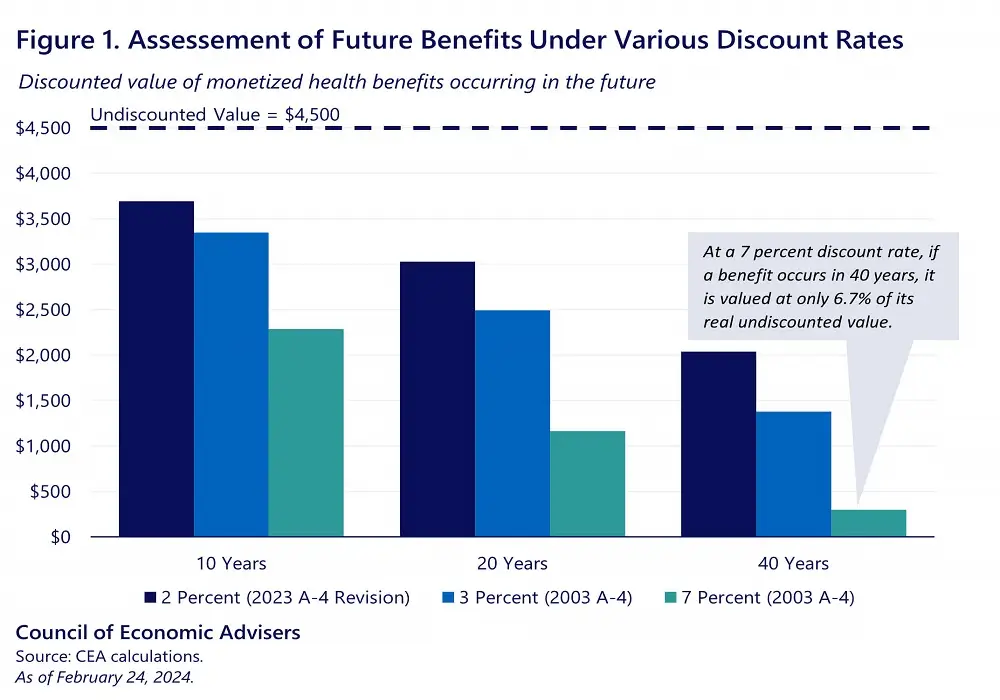

In public sector investments, especially those concerning infrastructure, health, and education, the expected benefits and costs span several years, if not decades. Governments often adopt a lower discount rate for such projects, emphasizing intergenerational equity and social welfare over short-term profitability. This approach reflects a long-term vision, ensuring that future generations reap benefits without being burdened by unsustainable costs. In projects where private sector involvement is significant, aligning the discount rate expectations with private investors while adjusting for public interest stands as a key governmental strategy.

- Sustainability and Environmental Considerations

In recent years, sustainability and environmental considerations have increasingly influenced government discount rate expectations. Nations worldwide are reassessing traditional economic models, factoring in the environmental costs and benefits of policy decisions. A green discount rate, often lower than the conventional rate, underscores the importance of long-term ecological sustainability. This shift reflects governments’ acknowledgment of climate risks, driving policies that prioritize investments in renewable energy, conservation projects, and sustainable urban development.

Comparing with Central Banks and Financial Markets

While governments focus on broader socio-economic and environmental objectives, central banks are predominantly concerned with monetary stability. The contrast between these priorities often manifests in differing discount rate expectations. Central banks might adjust rates based on inflation targets and market conditions, whereas governments may argue for adjustments considering overriding economic policies and societal needs.

Financial markets, on the other hand, are highly sensitive to changes in central bank policies, often reacting swiftly to any adjustment in discount rates. However, markets also gauge governmental fiscal policies, adapting to signals sent through public investment strategies and national budgets. This intricate interplay suggests that while central banks might tweak discount rates for immediate economic adjustments, governments wield the power to set broader fiscal expectations, potentially influencing long-term market strategies.

Challenges and Criticisms

Despite having its own expectations, government involvement in discount rate determinations can invite criticisms and challenges. Political interference is a key concern. When governments are seen as manipulating rates for immediate political gains, such as in the lead-up to elections, it can erode market confidence and lead to volatility. Moreover, underestimating discount rates to justify excessive borrowing for populist measures can strain economies in the long run.

Maintaining a transparent and consistent approach is thus vital. By fostering collaboration with central banks and incorporating expert insights, governments can better navigate the complexities of discount rate expectations, ensuring that fiscal strategies align with economic realities and public sentiments.

Conclusion: The Balance of Expectations

The question of whether governments have their distinct discount rate expectations is multifaceted, reflective of their broader fiscal and socio-economic mandates. While central banks aim for monetary balance, governments often prioritize socio-economic growth, sustainability, and intergenerational equity. Striking a balance between these varying expectations is crucial for holistic economic stability. As global economies evolve, so too will the interplay between policymakers, central banks, and financial markets, each influencing and adjusting to the ever-changing landscape of discount rate expectations.